Revenue Code 0120 is an important medical billing element used to charge costs for semi-private hospital rooms and meal services. It also directly ensures healthcare reimbursement and insurance claim processing functions correctly. Medical providers who understand Revenue Code 0120 properly gain both billing compliance and upper-level reimbursement results.

Hospitals and medical institutions depend on billing codes for hospital services to structure and bill all patient services. Revenue code 0120 is used for semi-private accommodations, typically referring to rooms with two or more beds. Proper classification using this code is crucial for medical institutions, as it ensures accurate documentation and invoicing of inpatient hospital stay costs.

What is Rev code 0120

0120 revenue code identifies semi-private accommodations that provide two beds for general inpatient treatment where medical specialists do not participate in the care process within healthcare facilities

- Service Type: Non-skilled nursing care (e.g., routine daily assistance)

- Accommodation: Shared room with two beds.

- Usage: Nursing Homes: The healthcare facility bills this code to residents in need of standard non-medical care.

- Hospitals: The service applies to semi-private room hospitalizations.

- Billing: The procedure uses CPT/HCPCS codes as well as other codes to indicate which services care providers will deliver.

Revenue code 0120 description

Revenue board services that provide two-bed accommodation for non-skilled nursing patients in healthcare settings. Revenue code 0120 accommodates standard healthcare stays in two-bed semi-private rooms, which exclude specialized medical services. The code serves both nursing homes, which furnish essential care to residents, and hospitals where patients stay together.

Claims involve attaching procedure codes from CPT or HCPCS series to define both provided services and room accommodation. The private single-bedroom revenue code is designated as 0110, while semi-private rooms separated by specialty use specific codes that range from 0121 to 0125. The billing accuracy of facility accommodations depends on revenue code 0120, simplifying the claims processing between insurers and healthcare providers.

How Revenue Code 0120 Affects Medical Billing

Medical billing depends on multiple specific revenue codes that serve to categorize healthcare expenses from patient treatments. The reimbursement process for patient accommodation depends on Revenue Code 0120, which provides essential functionality for inpatient facility compensation.

Key Ways Revenue Code 0120 Impacts Medical Billing:

- Accurate Charge Capture: Medical institutions can execute accurate billing by using Revenue Code 0120 to display the right room classification.

- Insurance Claims Processing: The determination of insurance eligibility depends on the revenue codes that insurance companies use for assessment. Medical institutions that use improper coding experience reject claims and have lower reimbursement rates.

- Billing Compliance: Healthcare institutions build their credibility by following coding guidelines because this action prevents both fraudulent claims and payment issues.

- Revenue Cycle Management: The correct coding of semi-private rooms facilitates reimbursement processing in a streamlined manner which minimizes financial expenses.

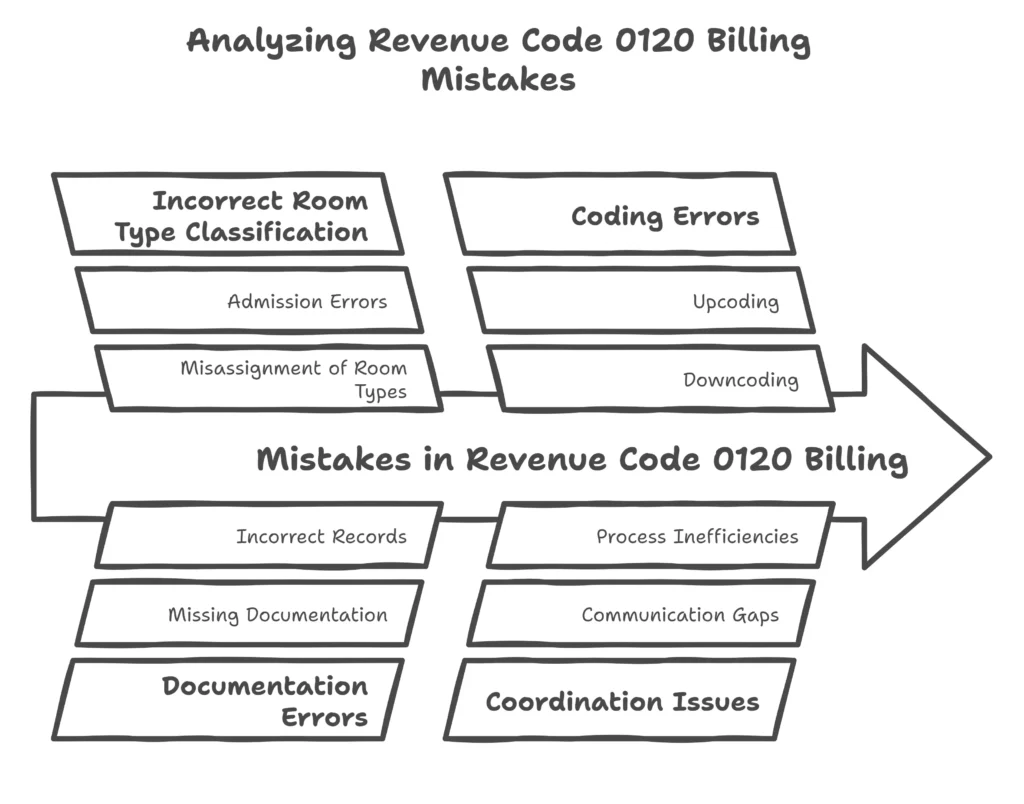

Common Mistakes with Revenue Code 0120 and How to Avoid Them

Incorrect billing practices result in denied claims while causing payment delays and non-compliance issues. Two frequent errors with Revenue Code 0120 consist of the following:

Incorrect Room Type Classification

- The mistake occurs when medical staff assigns Revenue Code 0120 to private rooms or ward spaces instead of semi-private healthcare facilities.

- Correct patient room classification must occur at admission to prevent incorrect billing in the system.

Missing or Incorrect Supporting Documentation

- The improper lack of supporting documentation becomes a mistake in Revenue Code 0120 use cases.

- Complete patient records that incorporate admission information along with room assignment records should be maintained.

Upcoding or Downcoding

- Healthcare providers face two errors in the billing process: they commit upcoding to gain higher payments and downcoding to obtain reduced reimbursements by incorrectly selecting revenue codes.

- Follow ethical billing practices and adhere to CMS (Centers for Medicare & Medicaid Services) guidelines.

Failure to Verify Insurance Policies

- The mistake occurs when staff members fail to verify that all insurance plans include coverage for semi-private room expenses.

- The clinician should review patient insurance coverage prior to billing so claims remain eligible and denial situations are prevented.

Improper Coordination Between Departments

- A break in communication processes exists between the admissions group and billing and coding sections within healthcare facilities.

- A solution includes implementing an efficient communication framework that provides precise and proper billing results.

The Impact of Revenue Code 0120 on Reimbursement

Hospital reimbursement rates receive substantial impact from Medicare Administrative Contractors through Revenue Code 0120. Insurance providers will offer full reimbursement on time when healthcare providers complete their documentation accurately. Standardized billing through revenue code 0120 leads to correct reimbursements since it allows insurers to process semi-private inpatient room claims based on facility rates and service types.

1. Insurance Plan Coverage

Health insurance companies implement particular requirements that determine their coverage of semi-private rooms by demanding advance approval or restricting payment only to medical necessities. Medicare allows deductible reimbursement for 0120 when patients require shared accommodations, but private insurers may cover this service based on what their policies outline.

2. Medical Necessity

Insurance coverage depends on established medical criteria showing the requirement for a semi-private room. Insurers usually refuse to pay for claims when medical records cannot demonstrate that sharing hospital accommodations is crucial to providing adequate care, such as patient safety and care monitoring needs. Hospitals need their ICD-10-CM code systems to match medical documentation and disease diagnosis information for necessary care validation.

3. Coding and Billing Errors

Denials and audits occur when CPT/HCPCS coding contains mistakes or revenue codes do not match properly (for example, using 0120 incorrectly when the correct code is 0150 for a private room). Consolidating hospital staff through training together with automated documentation solutions helps reduce associated risks.

4. Hospital-Acquired Conditions

The reimbursement value of the 0120 service could decrease or trigger denial when infections or other complications develop in semi-private accommodations since payers apply penalties to avoidable mistakes.

5. State and Federal Regulations

To avoid problems it is essential for facilities to follow both CMS standards and regulations that apply to their state policies. The Centers for Medicaid and Medicare Services will deduct facility payments through penalties when patients need skilled nursing above the semi-private room level. Private insurance companies implement Medicare Medicaid guidelines while maintaining higher standards for coverage approval.

6. Documentation Quality

The quality of detailed healthcare documentation, including admission orders, progress notes, and discharge summaries, determines healthcare payment amounts. Medicare payments decline, or denials occur when providers use 0120 for private rooms incorrectly and records contain incomplete information. This phenomenon is known to affect reimbursement negatively.

7. Readmission Patterns

Hospitals with elevated readmission rates for disease processes related to semi-private ward placement run the risk of receiving reduced reimbursements in value-based care programs. Payers now establish connections between healthcare payments and readmission rates together with other quality measurement criteria.

8. Facility Fees and Operational Costs

The amount of payment through 0120 depends on facility fees that handle operational expenses, including staffing and utilities. The payer institution modifies financial rewards based on several assessment factors, including regional payment standards and patient cost-sharing plan adjustments such as deductibles and coinsurance payments1.

9. Demographic and Geographic Variations

The reimbursement value of 0120 fluctuates according to both patient population characteristics and geographical area. Hospitals located in rural settings often get increased payments for special compensation needs but urban facilities must follow more stringent pricing regulations.

How to Maximize Reimbursement:

- All hospital room charges need proper documentary evidence.

- Verify insurance eligibility before admission.

- Compliant coding practices should be used to avoid audit activities and denials.

- Following reimbursement policies requires consistent updates to help healthcare providers meet both current and evolving regulations.

Revenue Code 0120 and Insurance Coverage: What You Need to Know

Each health insurance company implements different terms regarding hospital inpatient stays through its policies that influence Revenue Code 0120 coverage. Insurance management of semi-private room coverage becomes essential to prevent patient financial burden and hospital financial loss.

- Policy Variations: Insurance companies establish separate rules for reimbursing hospital room and board benefits costs. Healthcare insurance plans offer full coverage for semi-private hospital accommodations but some plans expect a copay or demand patients to meet their deductible first.

- Pre-Authorization Requirements: Healthcare insurers ask their policyholders to obtain prior authorization for them to subsidize semi-private room costs.

- Medicare and Medicaid Coverage: A semi-private hospital room receives Medicare Part A medical necessity coverage, and each state has different Medicaid coverage guidelines.

- Patient Financial Responsibility: Patients whose insurance does not pay for complete semi-private room costs need to pay outstanding expenses on their own.

Best Practices for Managing Insurance Coverage:

- Healthcare providers should check the status of insurance coverage with patients before admitting them to the facility.

- The healthcare provider must explain to patients their financial obligations regarding cost sharing in advance.

- The organization establishes correct documentation systems to prove its reimbursement claims successfully.

- Staff members who handle billing must receive training about various insurer policies, which will decrease insurance providers’ refusals of claims.

Best Practices for Billing with Revenue Code 0120

When using Revenue Code 0120 for their billing, healthcare providers can increase their reimbursement rates and meet requirements by following proper procedures.

1. Ensure Accurate Room Classification:

The correct assignment of revenue codes depends on the proper classification of inpatient rooms at patient admission times.

2. Verify Insurance Eligibility and Pre-Authorization:

It is essential to confirm patient insurance terms while getting pre-authorization for coverage in order to avoid denied claims.

3. Maintain Comprehensive Documentation:

Keep detailed records, including:

- Admission and discharge dates

- Room type assignments

- Physician orders and medical necessity justification

4. Use Automated Billing Systems:

Medical billing software should be used to automate the revenue code process and minimize employee error rates.

5. Train Staff on Compliance and Coding Guidelines:

Staff who perform medical billing need to participate in continuous training sessions to understand every updated rule and every required insurance policy.

6. Monitor and Audit Billing Practices:

Official audit procedures performed within the organization reveal errors that strengthen medical billing correctness.

7. Appeal Denied Claims Promptly:

Healthcare facilities must submit appeals containing necessary documentation to Revenue Code 0120 denial appeals.

8. Stay Updated on Regulatory Changes:

Disruptions in healthcare policies and regulations require ongoing monitoring since comprehensive awareness about changes ensures both regulatory compliance and excellent reimbursement outcomes.

9. Optimize Patient Communication:

The billing process requires clear information disclosure about semi-private room costs that patients need to understand properly.

10. Leverage Data Analytics:

Medical facilities benefit from using data analytics software to detect billing developments while decreasing mistakes and making their revenue cycle more efficient.

Conclusion:

Medical billing depends on Revenue Code 0120 to process payments for hospital patients occupying semi-private rooms as inpatients. Proper usage enables both reimbursement accuracy and insurance policy compliance and streamlines billing operations.

Successful revenue cycle management requires healthcare providers to do the following:

- Avoid common billing mistakes.

- Healthcare organizations must understand insurance policies that govern semi-private setting expenses.

- The organization needs to establish optimal billing procedures that boost reimbursement outcomes.

- Healthcare providers must maintain strict adherence to changing medical billing rules.

Such strategies help healthcare organizations reduce losses and obtain superior patient satisfaction through clear billing disclosure. Healthcare providers who maintain industry updates and do regular staff training will achieve greater billing accuracy leading to financial stability.